Despite persisting language barriers among EU inhabitants, the economical life throughout the EU is growing progressively together. Not least due to the strong will of some politicians, such as Wolfgang Schäuble (“For the future we need more Europe, not less Europe”) do we seek for a merging of the electronic commerce among the EU member countries. This will be achieved by adopting a new law by the end of 2013. This will initiate an enormous boost related to the cross-border European e-commerce.

Thus, it is very likely that e-commerce decision makers have to seriously consider expanding their businesses on an international scale, even if they have been hesitating so far due to fiscal or legal reasons.

However, one must not neglect the complexity of an internationalisation strategy. Anyone thinking that such a strategy is just about translating the existing website into other European languages, or even for those considering the implementation of new Google AdWords campaigns, as well as the adjustment of international shipping costs, will be easily outset by competitors. Especially for the fast growing European market one important e-commerce rule applies:

High investments in a sophisticated internationalisation strategy will achieve a much higher yield at the end of the day, than precipitately and rudimentary approaches.

Six issues require increased attention when working out a marketable internationalisation strategy:

- Variances in the importance of e-commerce in the different EU states

- Knowledge about the average online consumer within the different countries of the EU

- Evaluation of the adaptation efforts for a successful expansion in an EU member state

- Selecting the appropriate product assortment (regional diversification)

- Generating country-specific USPs (competitive advantages on a regional level)

- Elaborating a sustainable concept for continuous updates of the web shop’s content

Read more about the success factors for a shop internationalisation in the EU:

Variances in the importance of e-commerce in the different EU states

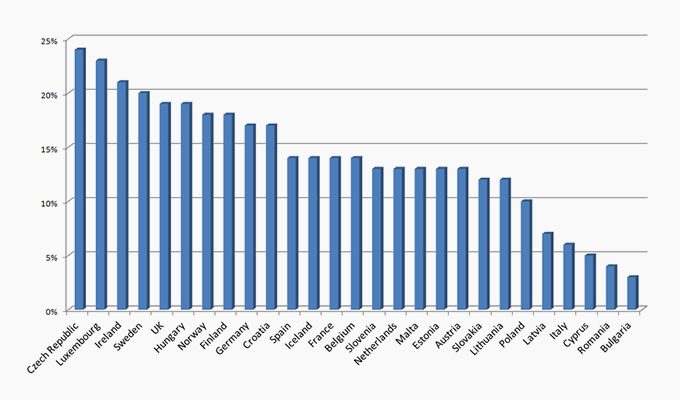

Recent results of a representative study of Eurostat, the Statistical Office of the European Union, reveal that the Czech Republic has currently the biggest share in total turnover in the e-commerce sector. This might seem surprising and ironic at the same time, as the eastern European countries are still considered to be lacking behind in certain respects. Nonetheless, companies in the Czech Republic generate by far more turnover through the online channel than other EU states. Here, e-commerce contributes already 24% to total income. In other words: Every fourth euro is generated via the online channel. Countries succeeding the Czech Republic are Luxembourg, Ireland, Sweden, the UK, Hungary, Norway and Finland (see graph below).

Germany only ranks tenth. Here, brick and mortar businesses still seem to be in the vanguard of the population.

Another study, investigating the usage of e-commerce platforms by the different EU countries, identifies Norway, Sweden and the UK to be the heading countries:

At the very end of the ranking are countries like Malta, Slovenia and Spain. In Spain, the percentage of individuals who have effectuated at least one online purchase in their life only reaches 31%. In other words: Only one out of three Spanish knows the feeling of waiting for an ordered package. The other two thirds have never experienced such a purchase but keep to their traditional local business infrastructure, which is consistent of small retail stores and almost no shopping malls or bigger department stores. Consequently, Spain incorporates two challenges: Not only is the e-commerce business poorly known, but also the local infrastructure is very ancient with its mom-and-pop stores, which are widely appreciated in this tradition-conscious southern European country.

To conclude: Online distributors should avoid starting their expansion in countries like Spain demonstrating a low dedication to e-commerce, but rather in eastern European countries, Scandinavia or the United Kingdom.

Knowledge about the average online consumer within the different countries of the EU

An essential detail for a successful market entry strategy is the precise analysis of the average online consumer of the corresponding country. For this purpose two basic questions have to be answered first:

- What is the general purchasing power of the behold country?

- How big is the need for the goods to be sold there? (Degree of market saturation)

This information is easily accessible in the internet (even when industry-specific characteristics are taken into account).

Evaluation of the adaptation efforts for a successful expansion in an EU member state

Any internationalisation endeavour automatically induces substantial investment expenses, otherwise the expansion has little chance to succeed. At the outset of an internationalisation strategy one should focus on one foreign country, in order to realise a sustainable and steady growth. A lot of time intensive and costly issues have to be considered, such as the translation of the web shop, legal reviews and possible adjustments of one’s terms and conditions. Furthermore a new, country-specific marketing strategy has to be developed, additional services, such as client services and shipping have to be established. Possibly you might also need another IT system including ERP and CRM.

Selecting the appropriate product assortment (regional diversification)

After having gained the necessary information about your target market, one has to figure out the product assortment which best matches the specific target group. It is strongly recommended to do a prior analysis by drawing assumptions for the extended web shop that are continuously tested in the following. In a classical Champion/ Challenger selection procedure (A/ B split) the better alternative will always be retained, while the other will be suppressed. Every new alternative must then be compared to the “Champion”. In the case that a new idea dominates the former “Champion”, the latter will be dismissed. By repeating these approximation methods incessantly, one will elaborate step by step the optimal product assortment for the new target market. The additional application of the automatic search result optimisation function (ASO) offered by FACT-Finder is the best way to provide the basis for great success.

Generating country-specific USPs (competitive advantages on a regional level)

Existing marketing activities and messages might not necessarily work out in the new target market. A country with low purchasing power is probably less interested in the exclusive quality of products or the permanent availability of those but more in an attractive purchasing price or a coupon (discount) for the next online order. Besides, special attention has to be paid to the Unique Selling Propositions (USPs) of your competitors. If one of them offers a 24-hour delivery service, you should be able to offer at least the same service. The more you get to know about the new target country and especially about its customer structure and their expectations, the better you can position yourself in the market by working out well-targeted USPs.

Elaborating a sustainable concept for continuous updates of the web shop’s content

In today’s fast moving times, nothing is more important than having a regularly updated webpage. For this reason, you should steadily update the content of your web shop according to local trends. Popular social events should be reflected in your web shop, as for example Valentine’s Day, carnival, Easter, etc. All these events should be linked to a special offer in your web shop. Good content pages can work as a catalyst thereby accelerating the overall performance of your e-commerce portal. Be creative and keep on introducing new and attractive contents. It is important to present your web shop with that certain indefinable something that is steadily updated. By doing so, you provide your customers with new buying arguments. Keep the golden rule in mind: Buying decisions are effectuated on an emotional basis, which applies uniformly to all EU citizens according to findings of the “Consumer Neuroscience” experts.